Starting on March 1 2023, you can file your income tax return. In these instructions, we’ll show you step by step how to incorporate your donations in your tax return filing!

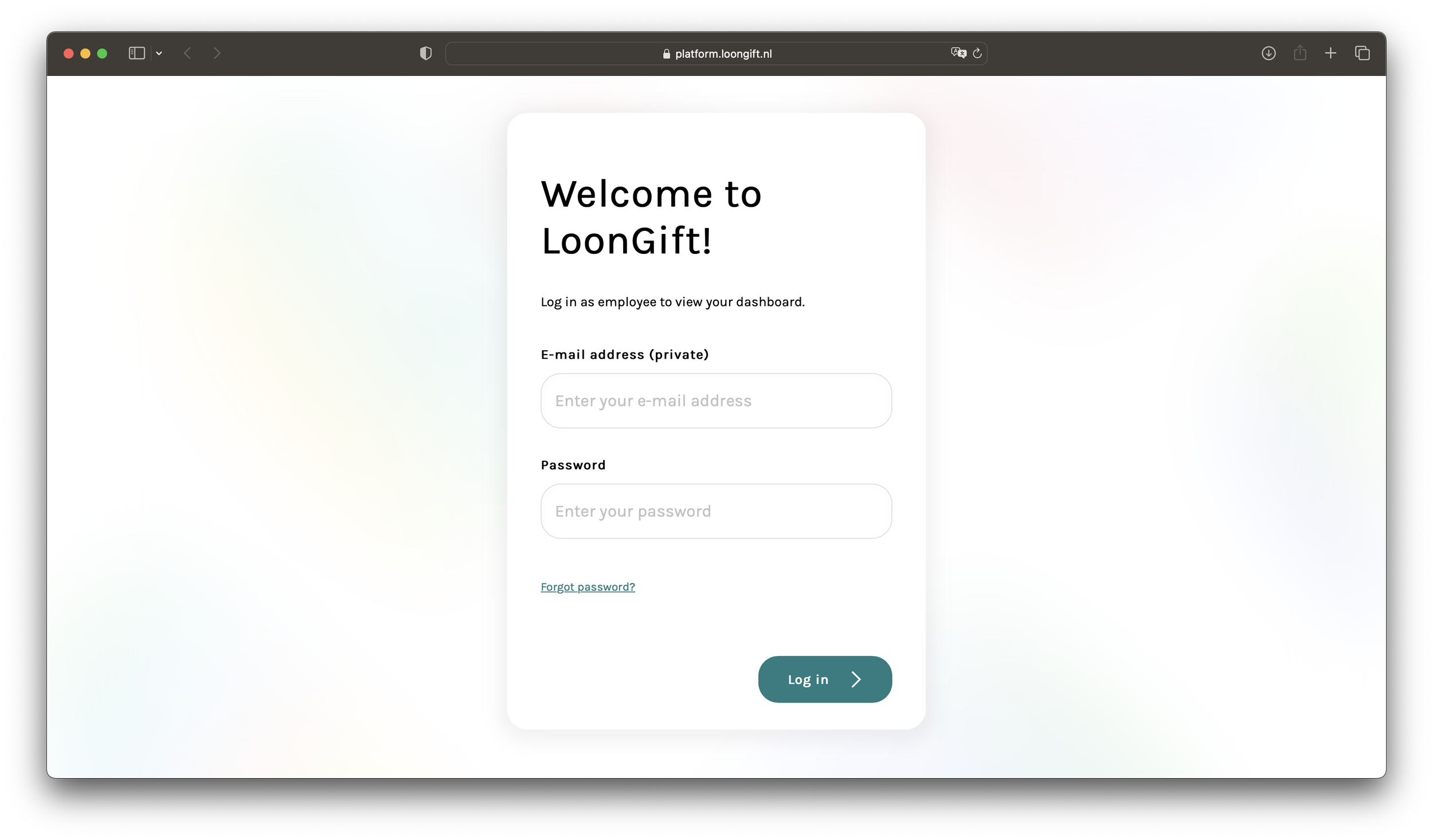

Step 1: Log in on the Payroll Giving platform

Log in on platform.loongift.nl/werknemers, to have the donation history of your Payroll Giving donation at hand.

Step 2: Go to belastingdienst.nl

Click on ‘Inloggen’ (‘Log in’) at the upper right corner and follow the steps to log in on Mijn Belastingdienst (‘My Tax Service’, in Dutch only).

Step 3: Click on ‘Inkomstenbelasting’ (‘Income Tax’)

Step 4: Click on ‘Belastingjaar 2022’ (‘Tax Year 2022’)

Follow the steps to file your tax return.

Step 5: At ‘Uitgaven’ (‘Expenses’), tick the box for ‘Giften aan’ (‘Donations to’)

Once you’re at the step ‘Uitgaven’ (‘Expenses’) in the menu on the left, you tick the box ‘Giften aan’ (‘Donations to’) and click on ‘Akkoord’ (‘Approve’).

Step 6: Fill in your donations (per charity)

After this you can enter your donations. Per charity, fill in the following information:

For the question ‘Was het een gift aan een ANBI (Algemeen Nut Beogende Insteling)?’ (‘Was it a donation to an ANBI’), you always answer ‘Ja’ (‘Yes’) for donations through the platform of The Social Handshake.

You can find the names and amounts of your donations for Payroll Giving in your donation history on your dashboard (see step 1). For your other donations you will find these in the email you received from us.

For ‘Gift aan’ (‘Donation to’), you fill in the name of the charity. The RSIN (identification number) is filled in automatically. You can check if you’ve selected the correct organisation with the RSIN via this link.

For ‘Bedrag’ (‘Amount’), you fill in the total amount that you’ve donated to this charity in 2022. Did you donate to the same charity with Payroll Giving and EnergieTeruggaaf/Emergency Giving for Ukraine? Then still enter these as two separate donations.

For a donation to a cultural charity (‘culturele instelling’), you receive an additional tax benefit. The additional benefit is calculated automatically in the filing of your tax return.

For the question ‘Was dit een periodieke gift die schriftelijk is vastgelegd?’ (‘Was this a periodic donation that was recorded in writing’) you answer ‘Ja’ (‘Yes’) for your Payroll Giving donation. Then, you’ll be asked for the transaction number of your donation. You can find your transaction number(s) in the email you received from us.

Answer ‘Nee’ (‘No’) for all your other donations.With ‘Deed u nog een gift?’ (‘Did you do additional donations?’), you can add another charity. Also fill in donations besides those done through the platform of The Social Handshake.

Step 7: Done!

Complete the filing of your tax return. In case you filed your tax return before April 1, you’ll receive information from the Tax Authority about your tax benefit on July 1 latest!

Participants are responsible themselves for correctly filing their tax return.

For any questions, please contact us at info@thesocialhandshake.com.